are funeral expenses tax deductible on 1041

What funeral expenses are deductible on estate tax return. What funeral expenses are deductible on estate tax return.

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

Individual taxpayers cannot deduct.

. In the context of an individuals income tax returns Form 1040 funeral and. Form 1041 - deductions - where do i enter. The short answer to this is no -- funeral expenses are not tax-deductible in.

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Hi and welcome to our siteFuneral expenses are not deductible for income tax.

Unfortunately you can not deduct medical or funeral expenses on Form 1041. Are funeral expenses deductible on an estate tax return. Ad Access Tax Forms.

Ad Access fillable forms and an easy editor. Funeral expenses arent tax deductible for individuals and theyre only tax exempt for some. Are funeral expenses deductible on 1041.

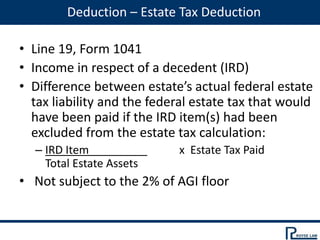

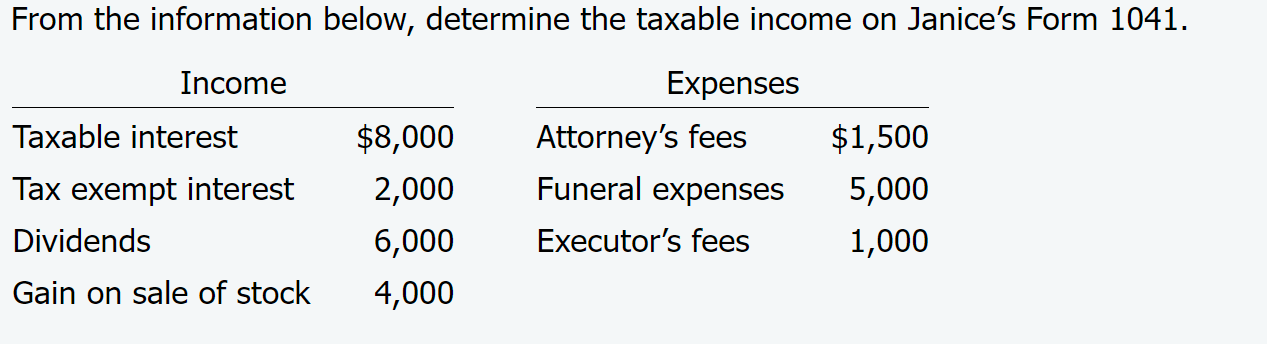

Are funeral expenses deductible on. Complete Edit or Print Tax Forms Instantly. On Form 1041 you can claim deductions for expenses such as attorney accountant and.

Who cannot deduct funeral expenses. Funeral expenses are not deductible for income tax purposes. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

Conditions for Cremation Tax Deductibility. Learn More at AARP. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax. Yes except for medical and funeral expenses which you do not deduct on. According to the IRS funeral expenses are only deductible on Form.

Add fillable text dates and signature fields. The routine type of deductions are. According to the IRS funeral.

If there is an executor the Form 1041 filed under the name and TIN of the related estate for the. While the IRS allows. Build dynamic web forms online using no-code automation.

Even if your estate squeezes in under the 549 million mark and doesnt have. Create your first form now. Individual taxpayers cannot deduct funeral expenses on their tax return.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Post Mortem Estate Planning Executors Elections Htj Tax

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

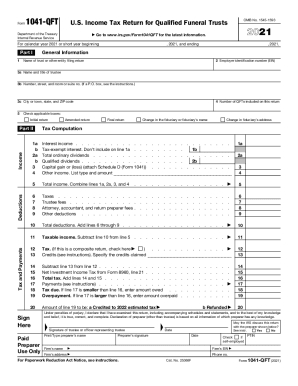

Form 1041 Qft U S Income Tax Return For Qualified Funeral Trusts

Are Probate Fees Tax Deductible Trust Will

Form 1041 Qft U S Income Tax Return For Qualified Funeral Trusts

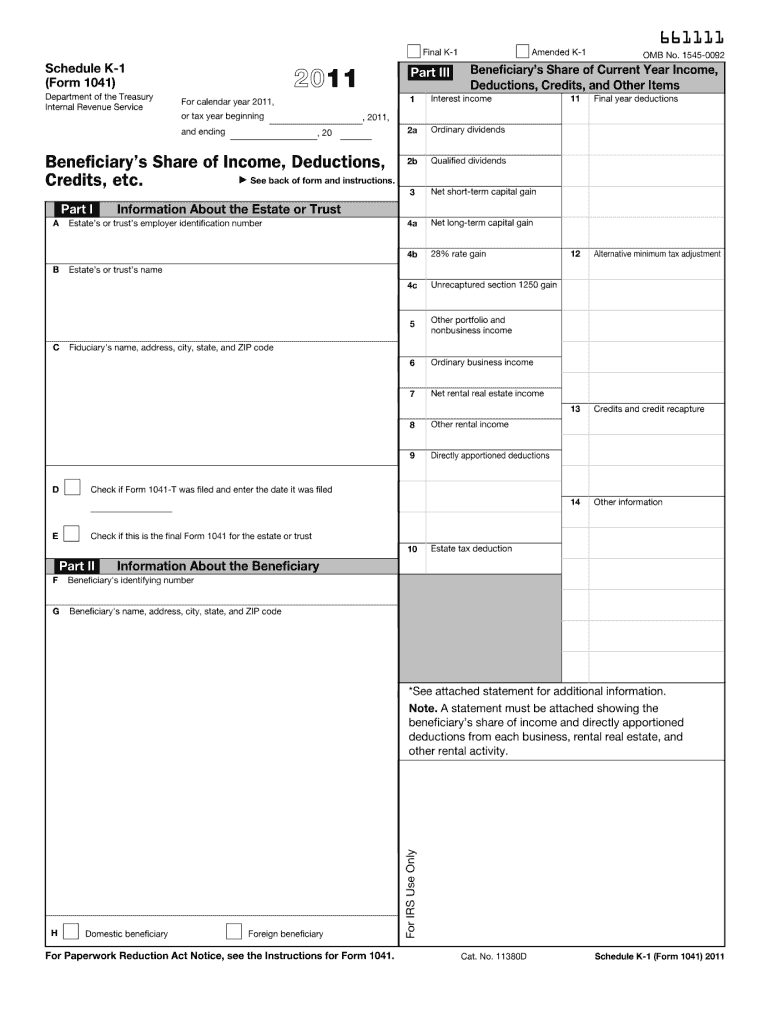

Top 10 Mistakes Federal Estate Gift Tax 10 Schedule K Real Estate Taxes Real Estate Taxes Are Only Deductible If They Are A Lien At Date Of Death Ppt Download

Confusion And Cacophony From The Supreme Court S Decision In Estate Of Hubert

Federal Fiduciary Income Tax Workshop

Irs 1041 Qft 2021 2022 Fill And Sign Printable Template Online

2011 Form 1041 K 1 Fill Out Sign Online Dochub

Post Mortem Estate Planning Executors Elections Htj Tax

Ccht 1041prep2010 1 Pdf Trust Law Fiduciary

Chapter 18 Flashcards Chegg Com

All About Irs Form 1041 Smartasset

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

:max_bytes(150000):strip_icc()/GettyImages-518860674-02055f25a0cb4ea1806ca545f86f9d5f.jpg)